University

Many are drawn to the fast-paced, flexible environment of the foreign exchange (forex) market, which is accessible to anyone ...

University

Many are drawn to the fast-paced, flexible environment of the foreign exchange (forex) market, which is accessible to anyone worldwide. However, the unfortunate reality is that a significant number of traders end up losing money and find themselves in worse financial and mental states than when they began. With the overwhelming amount of information available online, it can be challenging to distinguish valuable insights from misleading content. Unlike other markets, forex education is unique in its complexity and the search for credible sources. Success in forex often involves facing a series of failures, many of which are the result of applying ineffective market strategies repeatedly. Albert Einstein famously defined insanity as "doing the same thing over and over again and expecting different results," and this applies to forex. Repeated mistakes and bad habits can lead to self-destruction and distractions, diverting you from your path to financial independence.

Self Discipline

Ambition and drive are critical for success, but those who pursue greatness often face tests and hurdles. Venturing into new territories, such as forex trading, can lead to setbacks, particularly without proper guidance. Many of the world's most successful financial figures achieved financial freedom through persistence and self-belief, learning from their failures along the way. In forex, you will face psychological challenges, and it's crucial to understand that emotional discomfort is part of the process. Like a diamond, which becomes more brilliant the more it's cut, traders must endure setbacks to refine their skills. Forex can offer liberation and help you live the life you deserve, but only if you approach it with discipline.

Mental Attitude

A common misconception is that successful people work harder than the average person, but in forex trading, this belief doesn't hold true. You don't need to place more trades, use more indicators, or read more news to succeed. The key is smarter, more efficient trading, guided by a clear strategy. Forex traders must adopt a mindset focused on results per hour, not the number of hours worked. Extended workdays are not necessary and can lead to burnout. The most successful traders have conquered internal demons such as greed, doubt, and fear of missing out (FOMO). They focus on increasing their efficiency, which allows them to achieve more in less time. Clarity of purpose is essential, and consistent success requires coherent market forecasting. A trader's decisions, both immediate and long-term, define their market potential. It’s crucial to emphasize personal goals daily, as they foster a sense of control over your financial destiny.

Why the Majority Will Continue to Lose

Many new forex traders enter the market with unrealistic expectations, assuming it is a "get rich quick" scheme. They believe they can turn small sums of money into vast fortunes in a short time or that they’ll be able to quit their jobs quickly. These assumptions set them up for failure. Unrealistic expectations also create a damaging mindset, where traders feel pressured to make money quickly, leading to emotional trading. Emotional decisions are one of the fastest ways to lose capital. It's essential to approach the market with a clear, calm mindset and be financially prepared for losses, which are a natural part of trading. Trading is not suitable for everyone, especially those who cannot handle losses without becoming overly stressed. If a single loss can drive you crazy, forex is not the right field for you.

Things to Remember:

Neuroscientists say, “Neurons that fire together, wire together.” This means that repeated actions create new, deeper neural pathways in the brain over time. In simple terms, what you think, believe, and practice becomes ingrained in your neural structure. Therefore, repeated practice is essential for success. Confidence is key in trading, as it aligns you with your own judgment and fosters a positive attitude. Before executing a trade, you must trust your technical analysis. However, confidence should not be confused with cockiness, which can lead to poor decision-making and failure. The majority of the battle in forex is internal. Some traders boast about their profits to impress others, chasing bigger profits for social validation. This mindset is dangerous and often leads to losses. Success in forex requires humility and a clear focus on long-term goals.

Fibonacci

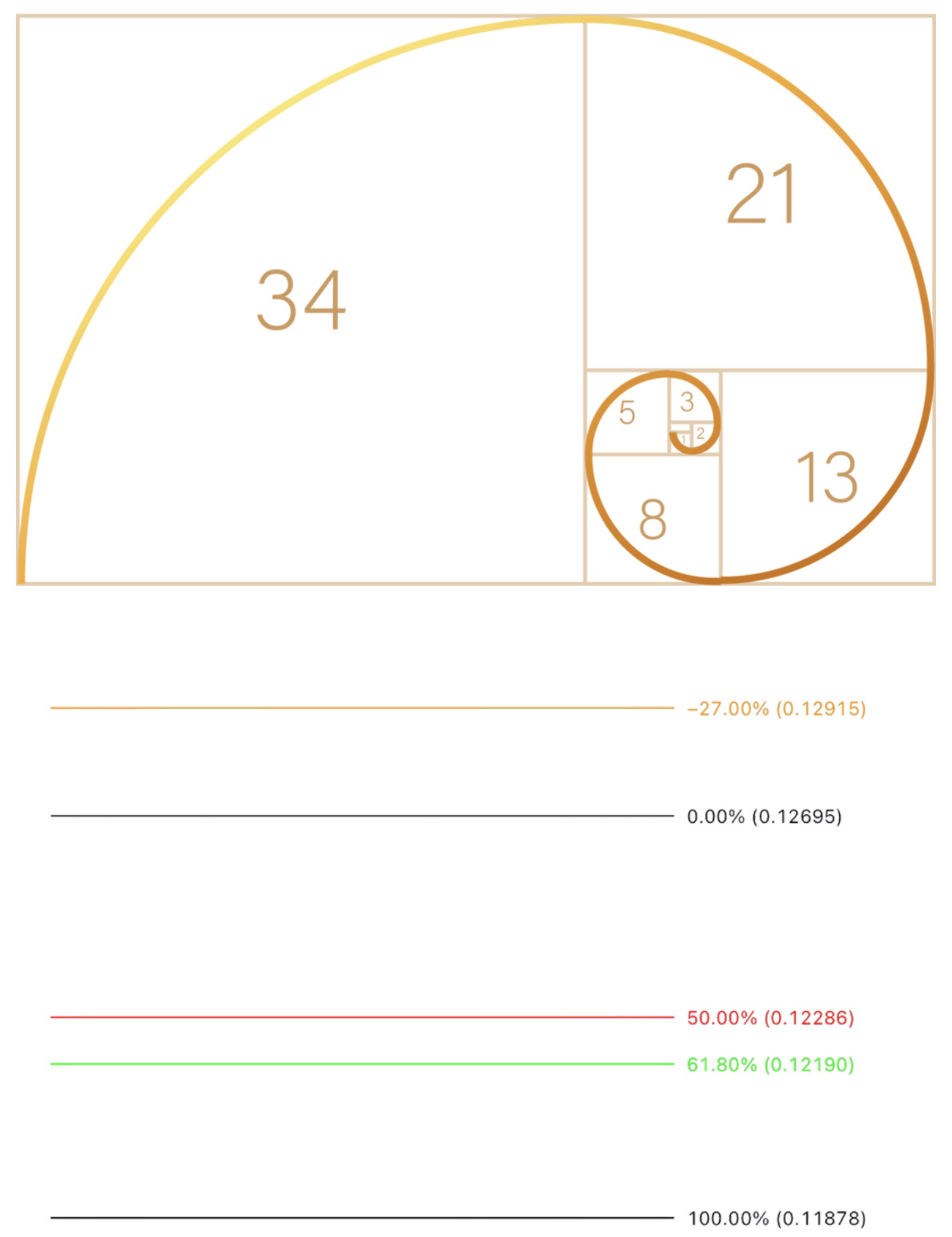

Correctly identifying market bias begins with accurately plotting key levels based on specific timeframes and price action methods. Without these foundational skills, the rest of your analysis will be unstable. While the forex market is dynamic, history often repeats itself. One of the most powerful analytical tools is Fibonacci, which helps measure market waves and retracements. Fibonacci sequences, which are found throughout nature and the human body, also apply to market movements. In forex, Fibonacci is used to measure retracements during trending markets. The Fibonacci sequence is: 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, and so on. Dividing a number in the sequence by the previous number yields the "golden ratio" of 1.618, which is critical in identifying retracement levels in a trending market. Technical traders rely on Fibonacci’s 50% and 61.8% retracement levels for support and resistance. If these levels fail to hold, traders often adjust their strategies, either exiting or reversing their positions. Understanding market psychology and recognizing these levels in advance can give traders a significant advantage.

Price Action and Timeframes

Price action (P.A.) is the practice of making trading decisions based on clean charts, free from lagging indicators. Financial markets produce price data over time, reflecting the collective actions of market participants. Economic variables also influence price movements, but price action analysis simplifies trading by focusing on core price data. P.A. can be used across all financial markets. Before starting your analysis, strip your charts of any unnecessary indicators, leaving only moving averages to help identify dynamic support and resistance areas. Analyze the long-term trends by looking at support and resistance levels, chart patterns, and candlestick formations on monthly and weekly charts.

A Bird’s Eye View

A higher timeframe offers a broader perspective on market movements, just as viewing the ground from 50,000 feet provides more clarity than a view from 5,000 feet. Amateur traders often focus on small timeframes, missing the longterm data necessary for consistent analysis and profitable trades.

Multiple timeframe analysis

Which considers both short- and long-term trends, is a thorough and effective method for analyzing currency pairs. It requires professional charting software and hard work, but it allows traders to identify strong buy or sell signals. Singular timeframe indicators or automated systems can be traps, while human judgment is essential for accurate market analysis.

Structure

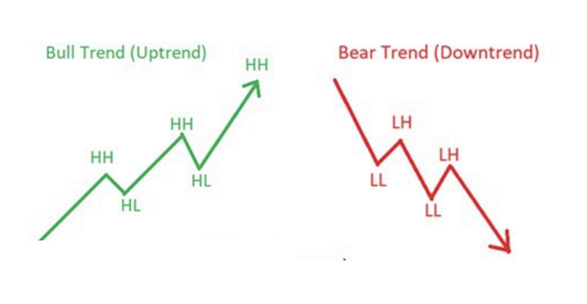

Each timeframe has its own structure, with higher timeframes ruling over lower ones. For example, a chaotic daily chart might show price trapped between two major barriers, while a lower timeframe might display a smooth trend. Top-down market analysis helps traders "break down the charts" and identify the beginning, middle, and end of trends. When a market is trending upwards on a higher timeframe, a lower timeframe may experience pullbacks, offering excellent entry opportunities. Recognizing these trends requires practice and a deep understanding of price action and Fibonacci tools. In conclusion, never limit yourself to analyzing just one timeframe. The forex market is complex and intelligent, and a broader perspective is necessary for success.