Kindergarten

A long time ago, cavemen used crude tools to make items, which they offered at bid-ask rates in their village markets. Fast forward to today...

Brokers: The Modern Day Market Middleman

A long time ago, cavemen used crude tools to make items, which they offered at bid-ask rates in their village markets. Fast forward to today, and we trade currencies through online brokers, with just a few clicks on a web-based platform! A broker gives you, the retail trader, instant access to the currency market. Without brokers, none of this would be possible. Every buy and sell order you place is executed through this middleman. And yes, just like when you were taught about money in nursery school, brokers take a commission for their work. Brokers come in all shapes and sizes, with some being regulated and others… not so much. Before you start trading in the forex market, you need a broker. And while the world has changed a lot since the days of street markets and fruit stalls, the broker is still your key to accessing market quotes and matching your orders to a liquidity provider.

What Exactly Does a Broker Do?

Think of a broker as a professional matchmaker. When you want to buy or sell a currency pair, the broker helps match your order with the right seller or buyer. Conveniently, brokers today offer platforms and apps that allow you to place trades from your mobile device, anywhere you have internet access.

Choosing the Right Broker: A Key Decision

Before picking a broker, do your homework! Check if they’re regulated by a financial authority and if they can cover any losses in case their business faces issues. Just like hiring an employee, you want to make sure they’re reliable. Check client reviews, withdrawal options, and customer service availability.

Types of Brokers:

Dealing Desk vs. Non-Dealing Desk

-

Dealing Desk Brokers (Market Makers)

-

These brokers might seem like they’re betting against you, but really, they just create a market for clients. They make money through spreads and sometimes widen them during major market events.

-

Best for traders with: Smaller trading volumes (<£10 per pip) Fewer, longer trades (held for over a day)

Non-Dealing Desk Brokers

These brokers don't place trades against you but instead use liquidity providers to get the best prices. They charge a commission but offer tighter spreads.

Best for traders with:

- Larger trading volumes (>£10 per pip)

- Scalpers who execute multiple trades daily

Key Considerations:

- Past client references

- Withdrawal speeds

- 24/7 customer support

Chart Types: Reading the Market

In forex trading, analyzing the market is crucial. You’ll use both technical and fundamental analysis to make decisions, but 90% of forex traders rely on technical analysis, which uses charts. Let’s dive into the three main chart types you’ll use:

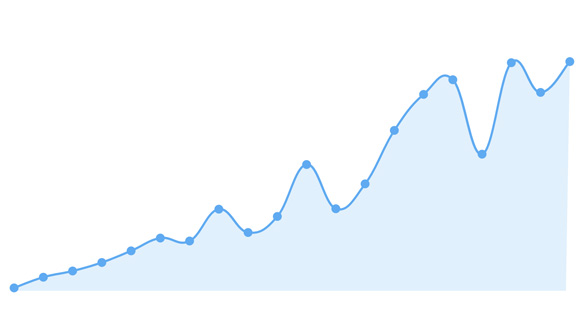

Line Charts.

Line charts are simple, connecting one closing price to the next. They’re great for identifying overall market trends and support/resistance levels but aren’t practical for detailed trading decisions.

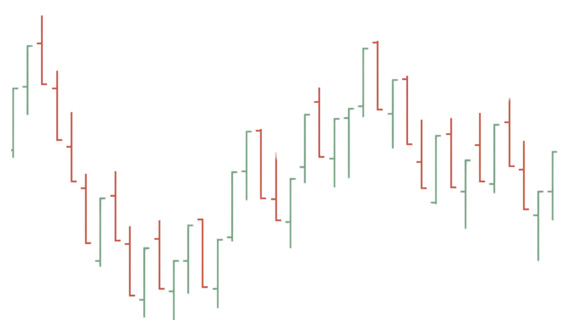

Bar Charts

Bar charts provide more information than line charts. They show the open, high, low, and close prices for a given time period. Each bar represents a specific time, making them useful for more precise trading decisions.

Bar Chart Breakdown:

High: Top of the vertical line Low: Bottom of the vertical line Open: Left horizontal line Close: Right horizontal line

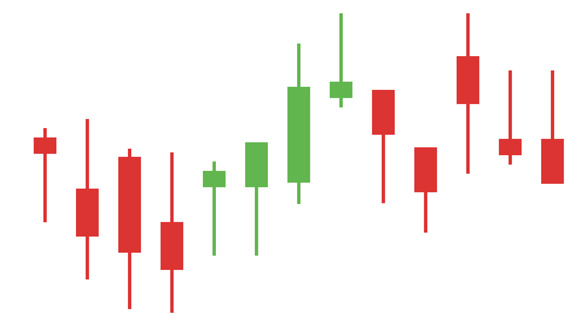

Candlesticks Charts (Our Favorite!)

Candlestick charts are the go-to for most traders. They show the same data as bar charts but in a more visual, intuitive way. The body of the candle represents the range between the open and close prices, and the wicks show the high and low.

Understanding Candlesticks:

- Green (or Bullish): The price closed higher than it opened

- Red (or Bearish): The price closed lower than it opened By mastering candlestick patterns, you’ll be able to interpret price movements effectively, giving you an edge in the market!