Nursery - Chapter 2

We understand that some of the language and key terms can seem daunting. But fear not! There’s no need for osetta Stone as we’ve...

We understand that some of the language and key terms can seem daunting. But fear not! There’s no need for Rosetta Stone as we’ve broken down the most common Forex-related lingo below.

Currency Pairs

Right, let’s start from the ground up. You’re here to learn about foreign exchange, not tobacco, not titanium, and not penny stocks, but currency pairs! You may be wondering if you must buy and sell the individual currency pairs at the exact same time. Let’s clear this up. All currencies are traded in pairs. These pairs are simultaneously bought/sold against each other for the transaction to be considered a “trade.” A large majority of the world’s currency pairs can be actively traded, provided that the brokerage platform you use offers them. For example, you can trade the British pound versus the US dollar, or the US dollar versus the Japanese yen. The decision is yours, and there is never a stationary or fixed value for a currency pair. All currency prices fluctuate while the market is open, and that is precisely how you make your money!

| MAJOR | Countries |

|---|---|

| EUR / USD | Euro Zone / US Dollar |

| GBP / USD | United Kingdom / US |

| USD / CHF | US / Switzerland |

| USD / JPY | US / Japan |

| AUD / USD | Australia / US |

| USD / CAD | US / Canada |

| NZD / USD | New Zealand / US |

| MINORS | Countries |

|---|---|

| EUR / GBP | Euro Zone / UK |

| EUR / JPY | Euro Zone / Japan |

| EUR / CHF | Euro Zone / Switzerland |

| EUR / NZD | Euro Zone / New Zealand |

| EUR / AUD | Euro Zone / Australia |

| EUR / CAD | Euro Zone / Canada |

| GBP / JPY | UK / Japan |

| GBP / CHF | UK / Switzerland |

| GBP / AUD | UK / Australia |

| GBP / CAD | UK / Canada |

| CHF / JPY | Switzerland / Japan |

| CAD / JPY | Canada / Japan |

| NZD / JPY | New Zealand / Japan |

| AUD / JPY | Australia / Japan |

These are just a few of the popular minor pairs, but there

are other currency pairs available for you to trade. For

example, the Turkish Lira vs. the Danish Krone. We heavily

suggest not bothering with such pairs as their movement

can be minimal, with high spreads (we'll explain spreads

soon!).

These are just a few of the popular minor pairs, but there

are other currency pairs available for you to trade. For

example, the Turkish Lira vs. the Danish Krone. We heavily

suggest not bothering with such pairs as their movement

can be minimal, with high spreads (we'll explain spreads

soon!).

To begin with, we recommend that you focus on just a few currency pairs. Most amateur traders try to trade more than 15 pairs at once! This leads to a damaged account and mental chaos. Less is certainly more in this market.

"It's better to be a master of one thing rather than simply knowing a bit about everything."

What is a PIP?

You've probably heard the term "pip" many times, but you might not yet grasp its importance. Though it's the smallest unit, it's also the most essential element in the forex market. Once we're done, the pip will become your central focus, paving the way for your future millions, so pay attention!

The fluctuation of each currency pair is calculated by the number of pips the price moves up or down. Each currency pair is quoted to five decimal places, with the fourth one representing the pip. The fifth decimal is known as a pipette, which is just one-tenth of a pip.

Example:

- GBP/USD: 1.5900 to 1.5905 = 5 pips increase.

- GBP/USD: 1.5000 to 1.4995 = 5 pips decrease.

For Yen-based pairs, the pip is calculated to two decimal places, and the third is the pipette.

Example:

- GBP/JPY: 191.33 to 191.38 = 5 pips increase.

- EUR/JPY: 145.78 to 138.80 = 698 pips decrease.

Successful traders focus on pips, not just monetary profits. Ensure your goal is making pips, keeping pips, and repeating until you achieve pip excellence!

Long, Short, and Flat Positions

Yes, these terms may often describe past relationships, but more importantly, they are positional terms used in forex trading to describe your bias on a currency pair.

- Long: You buy a pair expecting the first currency to rise.

- Short: You sell a pair anticipating a decline in the first currency.

- Flat: You have no position open, which is often a smart move when the market is unclear.

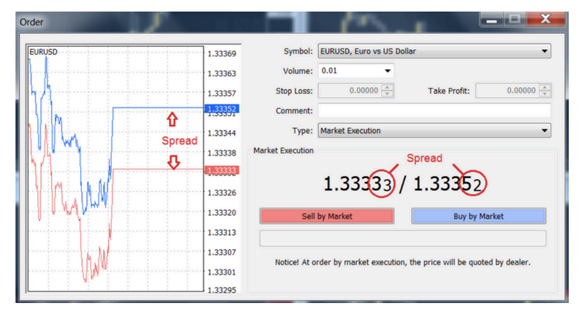

The Broker and the Spread

Every trade incurs a spread cost—the difference between the bid and ask prices of a currency pair, which is how brokers make money. Your broker acts as a middleman, taking a commission each time you trade. For example, the EUR/USD bid-ask spread might be 1.33333 – 1.33352, making the spread 2.1 pips. You must account for this spread as it will place your trade in negative territory by 2.1 pips the moment it’s executed.

Leverage and Margin

Leverage allows traders to control large positions with a smaller deposit. For instance, with a 100:1 leverage ratio, a £1000 trading account can control £100,000 worth of trades. While leverage can multiply profits, it can also magnify losses, so it’s important to use it wisely. Margin is a safety net for your broker to cover any potential losses. If your trade goes too far against you, your broker will issue a margin call, automatically closing your trade when your account balance drops below a certain threshold.

Stop Loss and Take Profit

- Stop Loss: A stop-loss order automatically exits a trade at a pre-set price level to minimize losses.

- Take Profit: This order automatically closes a trade in profit at a set target, ensuring gains are secured without the need for constant monitoring.

Always use stop-losses and take-profits to manage risk and lock in profits!