Nursery - Chapter 3

It's important not only to understand the nature of the forex market but also to be aware of its key participants. The forex market ...

Market Participants

It's important not only to understand the nature of the forex market but also to be aware of its key participants. The forex market attracts a wide variety of players who can be grouped into several categories. At Trade Tab University, most of you are here to educate yourselves on the world's largest financial market for personal gain and knowledge. Meanwhile, governments and other monetary bodies participate with motives tied to power and capitalism. Retail traders, like many of you, only became significant players starting in the 1990s.

1. Central Banks

Money is one of the most powerful tools in the world, and the global money supply is governed by central banks. These institutions form part of the G20 group and hold sway over the forex market by controlling interest rates and inflation, impacting a currency's purchasing power. Every country has a central bank responsible for maintaining economic stability and largely determining exchange rates. While central banks don't typically aim to profit directly from forex trades, they often earn revenue over time through large currency fluctuations, which are often triggered by their own announcements. Keep an eye on those 'high volatility' events on your macroeconomic calendar.

2. Businesses

International businesses that import or export goods must first convert their currency into that of their trading partner. Exchange rate fluctuations can directly impact a company's profits, so many businesses monitor currency movements even if they don’t directly trade in forex. Some companies even hire third-party analysts to provide market insights.

3. Smaller Banks

Commercial and investment banks play a huge role in the forex market, particularly by facilitating transactions for clients who borrow or deposit money. Major players like Deutsche Bank, JPMorgan, and Goldman Sachs control about 80% of the market. This gives them the power to manipulate prices and capitalize on liquidity. Larger banks may also trade among themselves using electronic broker systems, which often allow them to secure more favorable forex rates.

4. Hedge Funds

We’ve all heard the stories of hedge funds making millions and helping the rich get richer. Hedge funds employ high-risk but smart strategies to generate returns for their clients. Large trades from hedge funds can cause significant market movement, especially since they often hedge their positions to protect themselves from volatility. Some of the largest hedge funds, like those led by George Soros, have famously profited enormously from forex trades.

5. Retail Traders

Once you complete your journey with Trade Tab University, many of you will become retail traders, a group that makes up around 10% of market participants. Thanks to the advent of electronic trading platforms in the 1980s, anyone can now access the forex market. While wealth is constantly shifting through the market, entering without proper education often leads to losses—90% of retail traders fail. However, with the right strategy, discipline, and analysis, you can join the successful 10%. Who wouldn’t want the freedom that forex trading offers?

Forex Trading Hours

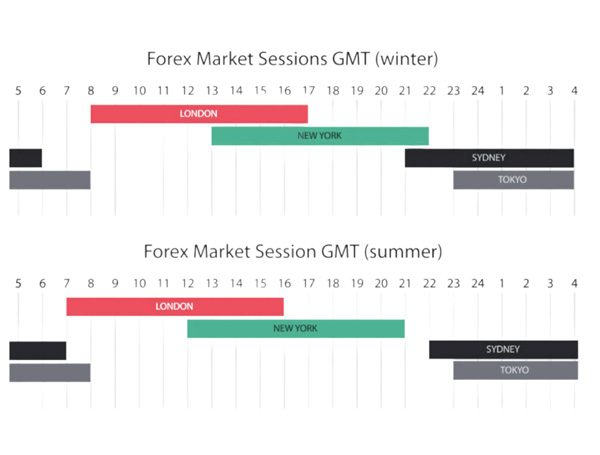

Unlike many markets that operate during fixed business hours, the forex market runs 24 hours a day, 5 days a week. It opens on Sunday at 10 PM GMT and closes on Friday at 10 PM GMT. Regardless of where you are in the world, you have access to the market anytime. However, it’s best to trade during periods of high activity. Here’s a breakdown:

- London Session (7 AM – 4 PM GMT) The London session is known for its volatility and accounts for 30-35% of all forex transactions. It’s a great time to trade if you’re based in the UK, as trends formed here often continue through the New York session. New York Session (12 PM – 8 PM GMT)

- The New York session is also highly liquid, especially during its overlap with the London session. A majority of market movements in this session are driven by U.S. dollar-related news and data releases.

- Tokyo Session (1 AM – 6 AM GMT) As the first market to open after the weekend, the Tokyo session is known for low volatility. Traders of the Japanese yen, Australian dollar, and New Zealand dollar will find activity in this session, but most price movements occur within tight ranges.

Forex vs. Other Markets

The forex market is often compared to other markets like stocks and futures, but there are important differences. Forex dwarfs other markets in volume, with daily turnover reaching over $4 trillion compared to the stock market’s $85 billion. This high volume offers forex traders more opportunities for profit, provided they manage risk and leverage properly. Another major distinction is that forex allows traders to profit from both rising and falling markets. While stock traders may be restricted from short selling during certain periods, forex traders can buy or sell currencies as they please. With only a handful of major currency pairs dominating the market, traders can avoid the "analysis paralysis" that often affects stock traders overwhelmed by too many options. By focusing on the right strategies and market conditions, forex offers faster and potentially larger returns compared to other financial markets.